Business Office Procedures

Student Organization Manual

A Resource and Policy Guide for the New and Existing Student Organizations of

Eastern Mennonite University

If your student organization has been granted funding, you will work with the business office to complete financial transactions. All forms are available in the Business Office and online through the www.myemu.edu portal. Students may need to request the student club or organization advisor to access the forms online.

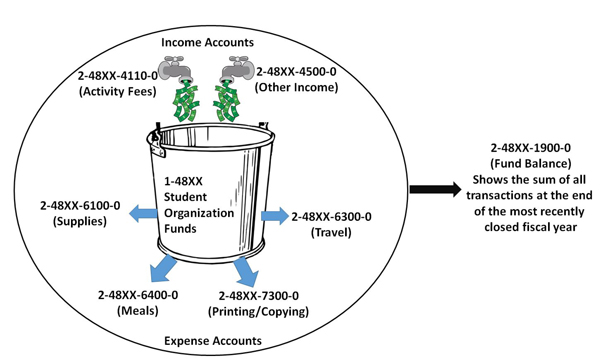

Accounts

Student clubs and organizations that meet certain criteria may be granted a set of EMU accounts to organize their finances. These generally include the following accounts:

|

2-48XX-1900-0 Fund Balance - Beginning of Year |

This fund balance account is used to “roll over” funds between fiscal years. Income cannot go into this account, and expenses cannot be paid out of it |

|

2-48XX-4110-0 Activity Fees |

This income account is used to receive allocations from SGA. This income usually posts around the beginning of the semester |

|

2-48XX-4200-0 Contributions |

This income account is used to receive tax-deductible donations to a club. These donations are processed through development, so that donors can get a receipt |

|

2-48XX-4500-0 Other Income |

This income account is used to receive income from fundraisers, funds collected to cover special events, etc. |

|

2-48XX-6100-0 Supplies |

This expense account is used to spend funds for supplies |

|

2-48XX-6300-0 Travel |

This expense account is used to spend funds for travel |

|

2-48XX-6400-0 Meals & Entertainment |

This expense account is used to spend funds for snacks, meals, etc. |

|

2-48XX-7300-0 Printing/Copy Services |

This expense account is used to spend funds for posters, handouts, etc. |

|

2-48XX-9900-0 Transfers |

This transfer account is used to move funds to a different club |

- If your club or organization is not eligible for a set of accounts based on the nature of your group or because you are in the two year probationary period prior to receiving a budget, SGA can still grant a funding request for an event or project (See Financial, Fundraising and Funding).

- In the above scenario, contact the SGA Treasurer for an SGA account and a project code to use. The project code will be an abbreviation of your organization’s name, used to label the transaction with your organization’s name.

Incoming Funds

- Each semester, SGA decides on an amount to allocate to each active student club or organization which has met the criteria to be granted an annual budget. This money is transferred by the business office into the -4110-0 account through a journal entry.

- If a donor wishes to make a tax-deductible donation to a student organization, please send the funds to the Development office, along with a Transmittal Form, to deposit the funds into the -4200-0 account.

- If you need to deposit funds collected through a fundraiser, or any donation that is not tax-deductible, please send the funds to the Business office, along with a Transmittal Form, to deposit the funds into the -4500-0 account.

Outgoing Funds

- Invoices billed to EMU can be sent to the business office for processing. Please write an expense account number (and project code, if necessary) on the invoice and obtain the advisor’s approval signature.

- If a payment should be issued to a vendor, but no invoice has been issued (for guest speaker honorariums, DJ services, etc.), a Request for Payment Form can be used to initiate payment. Note that EMU must have a W-9 on file for anyone who is paid for performing a service. Check with the Business office to verify whether or not we have a W-9 on file.

- Faculty/Staff advisors can use an EMU PNC card for purchases made on behalf of a student organization. When completing a Concur report, the club’s accounts (or project codes) should be entered for applicable transactions.

- If students cover club costs with personal funds, they can request reimbursement:

- If the amount to be reimbursed is less than $50, please complete a Petty Cash Form, attach the receipt, and make sure the form is signed by the club advisor. Bring this form to the business office for a cash reimbursement from the cashier.

- If the amount to be reimbursed is $50 or more, please complete an Expense Report, attach all receipts, and make sure the form is signed by the club advisor. Send this form to the business office, and a reimbursement check will be issued. (Note that Tuesday evening is the cutoff for each weekly check run. Forms received after Tuesday will be processed with the next week’s check batch.)

- Expenses over $3,000 require special pre-approval. Please contact the business office for instructions before placing an order over $3,000.